Department of Economics, University of Lahore, Pakistan

Received date: 29/08/2018; Accepted date: 03/10/2018; Published date: 15/10/2018

Visit for more related articles at Research & Reviews: Journal of Social Sciences

This study examined the impact of energy consumption, institutions and financial market on economic growth of Pakistan for the period of 1985-2014. Vector error correction (VECM) model is applied to analyze the short run and long run association among variables. Estimated results reveal that energy consumption, institutional quality, financial market, labor and capital have positive impact on economic growth while consumer price index and interest rate have negative impact on economic growth of Pakistan. It is suggested that government should increase the investment in energy sector and improve the institutional quality in the country while financial reforms and restructuring of financial sector will promote private lending so unemployment will be reduced.

Energy consumption, Institutions, Financial market, Economic growth

Economic growth is the conclusive result of many factors. Some of them are energy, institutional quality and financial markets having a significant impact on performance of an economy. Energy is the capacity of a physical system to do work and it is an accelerating factor of production. Moreover, high per-capita energy consumption is measured as an indicator of the level of economic development. In the literature, classical macroeconomic growth theories focus on labor or capital but not give attention to the role of energy, which is significant for economic growth and production process [1]. Industrial sector is an energy-intensive process; so continuous supply of energy is necessary to keep the production process in run.

Institutions also play a vital role in economic growth. Better institutions mean that better status of governance and implementation of government policies in the favor of public and week institutions may lead to economic chaos and under development. In literature, the most cited and acceptable definition of institutions [2] is that institutions are the structure of political, economic and legal interaction. Institutions and economic growth have strong relationship. A sound institutional environment in a country, give confidence to economic agents, both foreign and domestic, to invest more in business activities with high added value. Effective institutions have increased the efficiency, transparency, investment, saving and competition among private and public economic agents. If an institutional quality in a country is not good and market performs not well, it would enhance the uncertainty, irregularity, insecurity, political instability and corruption. These types of troubles are not healthy for economic growth of a country.

A strong financial sector is important for economic growth. Finance is a back bone and plays an essential role for every business to grow up. When business develops, ultimately economic growth gets better and raises the demand for credit. The soft monetary conditions and robust banking sector tend to increase more credit. Schumpeter [3], Shaw [4] and McKinnon [5] proved that financial market is an engine of economic growth due to its financial support for efficient investment and found a significant relationship among financial development and economic growth.

Pakistan have rich natural recourses such as oil, coal, gas, wind, water, sunshine, and wood but these resources are not fully utilized, even though most of them are still unexploited. Oil and gas are the main source to fulfill the energy requirements in Pakistan. According to Pakistan Economic Survey (various issues), domestic production of crude oil was 24.02 million barrels in 2015 but demand of oil was double so 4.98 million metric tons was imported. In 2014, Pakistan energy supply was 48.8 million tons oil equivalent and in 2015 it was increased by 50.9 million. But there is no change in per capita availability. During 2008-9 demand of electricity was 19080 Mega Watt (MW) against supply of 15055 MW thus short fall of 4025 MW. Similarly during 2014-15 demand of electricity was 21,000 MW and the supply was 15500 MW. So electricity short fall reaches 5500MW. Due to this calamity, the industrial sector is badly affected especially the major cities like Karachi, Faisalabad and Sialkot is affected by shutting down. Due to this, unemployment level is increasing rapidly reached to 6% in 2015. Due to the existing energy crisis in Pakistan, agriculture growth was 6.3% in 2006 which further turned down to 2.9% in 2015. According to the Pakistan Economic Survey 2015, agriculture food exports were declined by $3.990 billion in 2015 as compared to $4.563 billion in 2014, due to expensive inputs and lack of electricity facilities.

On the other side, the poor economic performance is result of institutional failure. Pakistan have week and ineffective institutional polices. A picture of institutional performance is mentioned below in Table 1.

Table 1: World Governance Indictor’s Percentile Rank of Pakistan 1996 & 2014.

| Indicators Percentile Rank* | 1996 | 2014 |

|---|---|---|

| Government effectiveness | 30 | 22.1 |

| Political stability | 12.5 | 3.4 |

| Regulatory quality | 30.9 | 27.8 |

| Rule of law | 28.7 | 23.5 |

| Voice and Accountability | 28.8 | 27 |

*0 shows lowest rank or 100 shows highest rank.

Table 1 shows that Pakistan is among those countries which has low institutional quality. All indicators of institution show that Pakistan’s rank in the world is very low. In 1996 Pakistan’s each indicator was 8.8, 30.0, 12.5, 30.9, 28.7 and 28.8 respectively, while in 2014 Control of corruption was the only indicator in which Pakistan’s rank had been improved. For all other indicators, value has been drastically decreased by 22.1, 3.4, 27.8, 23.5 and 27.0 respectively.

The financial sector of Pakistan is not functioning well also. In case of Pakistan stock market capitalization was 45.75% of GDP in 2007 and which was reduced by 19.47% of GDP in 20141.Economic growth is strongly influenced by the stock market. The domestic credit by banking sector in Pakistan has declined from 51.1% of GDP in 1971 and 15.5% of GDP in 20148 and domestic credit provided by financial sector to the private sector also declined from 27.7% of GDP in 1985 and 15.6% of GDP in 2014.

Many studies have investigated the individual impact of energy consumption, institutional quality, and financial sector on economic growth separately but there is hardly any study that investigated the joint impact of these variables on economic growth of the country. So this study is first attempt to determine the combined impact of energy consumption, institutions and financial market towards economic growth.

Hung [6] examined the impact of energy consumption and financial development on economic growth in US. In this paper author used neo-classical production function and auto regressive distributed lag (ARDL) bound test to examine the co integration between energy consumption and financial development during the period of 1967-2012 and variables that are under consideration are GDP per capita at constant price, energy consumption in kg of oil equivalent per capita and real domestic credit to private sector per capita and gross fixed capital formation. ARDL estimation shows a co integration relationship between energy consumption, financial development and economic growth. The finding indicate that there is no long term impact of energy consumption and financial development on economic growth of US economy but has short term impact on economic growth and capital has both short term and long term effects of economic growth. In this study author didn’t give any policy implication that how in long term US government could encourage the financial sector and raise the process of capitalization to produce a sound energy infrastructure.

Mercan and Gocer [7] investigated the effect of financial development on economic growth for five developing countries (Brazil, Russia, India, china, Turkey). Author was used panel data from 1989 to 2010. In this paper these variables were used for analysis, Growth rate, M2/GDP, foreign direct investment (FDI/GDP), and trade openness. Econometric model used in this study two-way fixed effects model. According to the empirical evidence result shows that the impact of financial development on economic growth has positive and statistically significant and other variables foreign direct investment or trade openness had also the most significant outcome on the economic growth.

In the case of new 7 industrialized countries - Turkey, Thailand, Philippines, Malaysia, Mexico and South Africa, Zaren and Koc [8] aimed to analyze the causality relationship between energy consumption and financial development by using asymmetric causality test. The sample data was taken from 1971 to 2011. In this paper three financial development indicators were used, (1: deposit money bank assets to GDP ratio, 2: financial system deposit to GDP ratio, 3: private credit to GDP ratio). The data for energy is measured as energy use in kg of oil equivalent per capita. The empirical findings show that both positive and negative shocks exist in Malaysia and Mexico. In Philippines there is only negative shock whereas in India, Turkey, and Thailand, two way causality exist but there is no any causality exists in South Africa.

Demetriads and Law [9] worked on the interaction between finance and institutions on economic development. They took sample size of 72 countries for the period 1978 through 2000. Author used these variables, real GDP per capita, real gross capital formation, total labor force, and three different financial development indicators (liquid liabilities, private sector credit and domestic credit provided by the banking sector) and six institutional variables (institutional quality, voice accountability, rule and law, corruption, government effectiveness, Bureaucratic quality). The Cobb-Douglas production function was used in this study. The findings of this paper suggest that financial development has larger impact on economic growth when institutional frame work is healthier. In the third world countries there is low institutional quality, so financial sector do not perform well.

Compton and Giedeman [10] captured the link between institutions, financial development or economic growth. They used cross section and panel approaches on data from 1970 to 2004. In this paper these variables were used for analysis, GDP per capita, government consumption as percentage of GDP, stock market development, private credit by deposit money bank relative to GDP, rule of law, corruption and quality of bureaucratic, contract intensive money. The empirically findings shows that banking development and well-functioning institutions are contributed to growth process. Second findings that institutions and bank development are substitute in the growth process.

Theoretical Framework

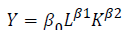

This study used Cobb Douglas production function to derive the model.

(1)

(1)

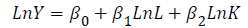

By taking log of eqn. (1), the equation becomes

(2)

(2)

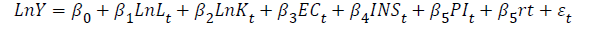

As the energy consumption, institutions and financial market are main consideration of this study. So there is need to add the variables of energy consumption, institution and financial market in eqn. (2). To analyze the impact of energy consumption, Institutions and financial market on economic growth, indices of these variables are constructed while consumer price index (CPI) and interest rate are used as control variable to derive the eqn. (3).

(3)

(3)

In above equation, Y=Gross domestic product as a dependent variable, L=total employed labor force, K=gross fixed capital formation used as proxy, EC=energy consumption, INS=institutional quality, FM=financial market, PI=price index used as a proxy of GDP deflator, r=interest rate is proxy for call money rate.

The data has been collected from World development indicator (WDI), Pakistan Economic Survey (various issues), State bank of Pakistan and International Country Risk Guide for the period of 1985 to 2015. Gross domestic product, total employed labor force, and gross fixed capital formation are collected in local currency unit in Rs. Million, Energy consumption variables are collected in million tons. Financial market indicators are collected in percentage of real GDP. Institutional data are collected from international country risk guide.

Empirical Analysis

This section focuses on empirical relationship among energy consumption, institutions and financial market on economic growth of Pakistan. Firstly, Augmented Dickey Fuller (ADF) and Phillips-Perron (PP) unit root tests are used to check the stationarity of the variables, which is pre-condition for co-integrated models. Johansen co integration test is applied to check if there is any co integrating vector and thus it can be concluded that there is a long run association among variables. Next, as per the results of Johansson test of co integration, vector error correction model is applied to examine the short run and long run relationship among variables (Table 2).

Table 2: Unit root test (ADF and PP test) (Source: Calculated by authors).

| Variables | P-values (At level) | Status | P-values (At 1st Diff. ) | Status | ||

|---|---|---|---|---|---|---|

| ADF | PP | ADF | PP | |||

| GDP | 0.3587 | 0.515 | Non stationary | 0.0277 | 0.0277 | Stationary |

| L | 0.9678 | 0.5237 | Non stationary | 0 | 0 | Stationary |

| K | 0.5199 | 0.5237 | Non stationary | 0.0002 | 0.0001 | Stationary |

| EC | 0.4151 | 0.4988 | Non stationary | 0.004 | 0.0075 | Stationary |

| INS | 0.2177 | 0.1593 | Non stationary | 0.0012 | 0.0011 | Stationary |

| FM | 0.2907 | 0.1841 | Non stationary | 0.0001 | 0.0001 | Stationary |

| PI | 0.3032 | 0.251 | Non stationary | 0 | 0 | Stationary |

| r | 0.3774 | 0.2384 | Non stationary | 0.0013 | 0.0016 | Stationary |

Augmented Dicky Fuller (ADF) or Phillip Perron (PP) tests are applied to check the stationarity of each variable. Results from both ADF and PP test shows that all the variables are stationary at first difference. After finding the stationarity of variables, confirmation of cointegrtaion between the variables is needed. For this purpose, Johanson cointegration test is applied. But before applying cointegration test, we need to find out the optimum lags of the model.

The optimum lag selection is found with the help of VARSOC (vector auto regressive specification order criterion) which shows that FPE (final prediction error), AIC (Akaike Information Criterion) and HQIC (Hannan and Quinn Information Criterion) for optimum lag selection. These criteria recommended two optimum lags for the model.

Now Johansen cointegration technique is applied to test whether series is cointegrated or not.

Table 3 shows that trace statistics is less than 5% critical value test at rank 3 so there is cointegration among variables. As cointegration exists, Vector Error Correction Model can be applied for long run and short run relationship among the variables.

Table 3: Johansen Cointegration Test (Source: calculated by author).

| Maximum rank | Eigenvalue | T-statistic | 0.05 Critical Value |

|---|---|---|---|

| 0 | . | 189.935 | 124.24 |

| 1 | 0.89641 | 126.4503 | 94.15 |

| 2 | 0.78881 | 82.9111 | 68.52 |

| 3 | 0.75528 | 43.4970* | 47.21 |

| 4 | 0.51394 | 23.297 | 29.68 |

| 5 | 0.45396 | 7.2632 | 15.41 |

| 6 | 0.022848 | 0.0004 | 3.76 |

| 7 | 0.00001 |

Table 4 shows the value of R2 which is 0.9301, means that explanatory variables in the system explain 93 percent variation in dependent variable. And P>chi2 shows that the model is overall good fit.

Table 4: Fitness of Short Run Equation (Source: Calculated by authors).

| Equation | RMSE | R2 | Adjusted R2 | Chi2 | P>chi square |

|---|---|---|---|---|---|

| Y | 0.015092 | 0.9301 | 0.91 | 226.3313 | 0 |

Table 5 contains the lagged error correction term of the model. The coefficient of dependent variable is negative and significant. So we can conclude that there exists long run relationship from explanatory variables (K, L, EC, INS, FM, PI, and r) to dependent variable GDP.

Table 5: Lagged Error Correction Term (Source: calculated by author).

| D-Y | Coefficient | Std. Err | P value |

|---|---|---|---|

| _Ce1 | -0.42676 | 0.184795 | 0.021 |

Table 6 shows the coefficient of estimated parameters of short run, along with their standard error, P-values and significant status. It is estimated that labor, capital, institutional index, price index and interest rate are insignificant in short run, which means that these variables have no effect on economic growth of Pakistan in short run. Labor force is insignificant in the short run which means that it is not contributing to economic growth of Pakistan in short run, because it takes time to launch final products in the market which produced by the labor force. Capital is insignificant in short run because it takes time to attain the outcome of investment projects because it is long run phenomenon. Result shows that Energy consumption and financial market are significant while institutions are insignificant in the short run. Price index and interest rate are also insignificant in the short run.

Table 6: Short Run Results (Source: Calculated by authors).

| Variables | Coefficient | Std. Err | P-value | Status |

|---|---|---|---|---|

| L | 0.204853 | 0.173539 | 0.238 | Insignificant |

| K | 0.098541 | 0.104203 | 0.344 | Insignificant |

| EC | 0.508299 | 0.0217 | 0.019 | Significant at 5% |

| INS | -0.00373 | 0.003014 | 0.216 | Insignificant |

| FM | -0.00968 | 0.00555 | 0.081 | Significant at 10% |

| PI | -1.20E-05 | 5.09E-05 | 0.807 | Insignificant |

| r | -0.00387 | 0.003557 | 0.277 | Insignificant |

| Constant | 0.227481 | 0.009302 | 0.014 | Significant at 5% |

Table 7 shows information about the sample of long run, P value which shows that overall model is fit.

Table 7: Fitness of the Long Run Equation (Source: Calculated by authors).

| Equation | Parms | Chi2 | P>chi2 |

|---|---|---|---|

| _Ce1 | 7 | 315.5317 | 0 |

Table 8 presents the long run coefficients along with standard errors, p-values and significance status of all independent variables. The results show that labor, capital, energy consumption, institutions, financial market, price index and interest rate are significant in long run. Labor force coefficient is positive and significant. If there is 1% increases in the labor force, it will bring the 0.853407% increase the economic growth. It means that labor force is contributing to economic growth because agricultural sector take in large number of labor force occupied in this sector which contributes to growth positively and significantly. These findings are similar to previous records, describes that labor force is contributing to growth in developing countries of South Asia. Capital effects economic growth positively and significantly. Above results show that if 1% increases in the capital, it will bring the 0.431649% increases the economic growth. These results are similar to the findings of Ramirez and Nazmi [11] states that in developing countries investment contribute to economic growth in long run.

Table 8: Long Run Results (Source: Calculated by authors).

| Variables | Coefficient | Std.Err | P-value | Status |

|---|---|---|---|---|

| L | 0.853407 | 0.079164 | 0 | Significant at 1% |

| K | 0.431649 | 0.035384 | 0 | Significant at 1% |

| EC | 0.05537 | 0.006858 | 0.044 | Significant at 5% |

| INT | 0.003276 | 0.001629 | 0 | Significant at 1% |

| FM | 0.016407 | 0.004021 | 0 | Significant at 1% |

| PI | -0.00015 | 2.92E-05 | 0 | Significant at 1% |

| r | -0.00696 | 0.001477 | 0 | Significant at 1% |

| Constant | 6.204164 |

Energy consumption index coefficient value shows positive and significant relationship with growth which indicates that if energy consumption increased by 1%, it will bring the increase in the economic growth by 0.0553703%. Because if there will be a sufficient and efficiently utilization of energy, it will positive influence our industrial sector, bring agricultural reforms, reduce the unemployment and poverty, that will consequentially enhance the economic growth in the long run. This result is accordance with the past studies [12,13] which indicate that energy consumption has positive impact on economic growth in the long run.

Institutional quality index shows that positive and significant impact on the economic growth. If 1% increases in the institutional quality, it will bring the increase in the economic growth .0032756%. Siddiqui [14] also found a strong relationship with the institutional quality and economic growth in the developing countries.

Financial market index coefficient shows that it has positive and significant impact on economic growth. Strong financial market enhanced the investment, capital formation ultimately economic growth increased in the long run. In the above table result show that if 1 % improves in the financial market, it will bring the increase in the economic growth by 0.0164065%. This result is similar to the findings of Sansui and Sallah [15], Shahbaz et al. [16].

Interest rate shows significant and negative coefficient sign shows that when interest rate is low, indirectly it encourage investment. Interest rate has direct impact on investment but it has indirect impact on economic growth. When interest is low the rate of investment is high it has positive influence on economic growth of Pakistan in long run.

Price index shows negative and significant impact on economic growth in long run. High and long term inflation reduces to economic growth. This result is supported by several earlier studies like, Khan and Senhadji [17] and Motley [18] shows negative relationship between high inflation rate and economic growth.

This study examined the impact of energy consumption, institutions and financial market on economic growth of Pakistan for the period of 1985-2015. In this study Vector error correction (VECM) model is used to analyze the short run and long run association among energy consumption, institutions, financial market and economic growth while labor, capital, Price index and interest rate are used as control variables. Estimated results show that all explanatory variables (labor, capital, energy consumption, institutions, financial market, price index and interest rate) are significant in the long run. Energy consumption, institutions, financial market, labor and capital have positive impact on economic growth while price index and interest rate have negative impact on economic growth. In short run energy consumption and financial market have significant impact however labor, capital, price index and interest rate have insignificant impact on economic growth. Based on estimated results, it is concluded that energy consumption institutional quality and financial markets contribute positively and significantly contribute to economic growth of Pakistan.

This study suggests that government should increase the investment in energy sector to enhance the economic growth and has to take serious steps to reduce the import of oil and current account deficit and there is need to utilize the domestic natural resources to meet the energy requirements.

There is dire need to pay attention for stability and improvement of institutional quality in the country. High quality institutions will restore the confidence of people that will lead to promote the economic growth. Strong institutional systems bring sound financial system having significant impact on the economic growth. Consequently, it is strongly recommended that government should bring financial reforms and restructuring of financial sector in Pakistan. Financial sector has to promote private lending at lowest interest rate that will enhance the business activities and fulfill the deficiency of energy sector so unemployment will be reduced by improving the economic growth of the country. It is also suggested that Pakistan should have optimal inflation rate which would encourage producers to invest and produce more goods so that people have variety of goods to consume which is beneficial for the economic growth.