Priyank Kulshreshtha1*, Santi Swarup K1, Swami Prasad Saxena2

1Department of Management, Dayalbagh Educational Institute, Agra, India

2Department of Applied Business Economics, Dayalbagh Educational Institute, Agra, India

Received: 27-Jun-2023, Manuscript No. JSS-23-104018; Editor assigned: 29-Jun-2023, Pre QC No. JSS-23-104018 (PQ); Reviewed: 13-Jul-2023, QC No. JSS-23-104018; Revised: 27-Dec-2023, Manuscript No. JSS-23-104018 (R); Published: 04-Jan-2024, DOI: 10.4172/JSS.10.1.002

Citation: Kulshreshtha P, et al. An Empirical Study to Trace the Impact of Macro-Economic Variables and Information Asymmetry on the Aum of Indian Mutual Funds- A Vecm and E-Garch Model Approach. RRJ SocSci. 2024;10:002.

Copyright: © 2024 Kulshreshtha P, et al. This is an open-access article distributed under the terms of the creative commons attribution license, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Visit for more related articles at Research & Reviews: Journal of Social Sciences

Early theories of finance discarded the role of human behaviour in decision making, but over a period it is realised that human emotions play pivotal role in investors’ choice. Investors’ behaviour gets affected by so many factors namely personal factors, demographic factors, geographic factors, regulatory factors, macro- economic factors etc. Amongst these factors, macro-economic factors play a direct and important role in investment decision making because these factors impact entire system. In this study the impact of macro-economic variables is tracked on the investors’ behaviour towards mutual funds by taking Assets Under Management (AUM) as a proxy of for investor behaviour. Further, this study attempts to trace the impact of bad news on the investor behaviour. For accomplishing the objectives vector error correction model and E-GARCH model is used. It is found that 6 identified macro-economic variables explain 48% variation in the AUM and the error correction term is not statistically significant and it is also found that leverage effect exists in AUM which means that bad news impacts the volatility of AUM more than good news.

Assets under management; E-GARCH model; Leverage effect; Macro- economic factors; Vector Error Correction Model (VECM)

Mutual fund has become one of the most popular investment avenues now a days due to its relatively higher returns for low risk and no active management on the part of investors. Moreover, mutual funds offer variety of investment options amongst which one or many funds can be selected depending on investors’ investment objectives, risk appetite and returns expectations such as equity oriented funds, where entire money gets invested in equity shares of company or debt oriented funds, where money gets invested in debentures or bonds or hybrid funds where portfolios pertain an optimum mix of equity and debt. All these funds fundamentally work on the principle of diversification but serves to the different clientele. The key measure to test the success of any fund is AUM. AUM is the market value of the securities managed by an Asset Management Company (AMC) on behalf of their clients. So, if AUM is increased it results in increased revenues to the AMCs in the form of management fees. The value of AUM changes due to various factors like inflows and outflows of funds, the market value of securities in the portfolio and the number of dividends paid by the company in the portfolio of AMC. Thus, it can be said that AUM gets affected by market forces and, reflects investors’ perception towards mutual funds hence it can be concluded that AUM is the proxy to measure the interest of clients towards various kinds of investment options [1].

As it is discussed that AUM gets affected by the market value of securities in which money is invested and market value is a function of multiple market forces which are broadly classified as micro-economic forces and macro-economic forces. Micro-economic forces are demand or supply of a particular security whereas macro-economic factors are those factors which affect the entire system and their impact cannot be avoided and these factors play a prominent role in determining the prices of any security. Which result in fluctuation of the values of AUM. Since AUM acts as a proxy to the investor sentiments, the impact of changes in macro-economic factors is inevitable. Our study attempts to address this question that, whether various macroeconomic factors affect the assets under management or not? if yes then in what magnitude and what is the direction of the relationship? Study also endeavours to check for leverage effect in AUM [2].

There is extensive literature available on the performance of mutual funds and investors’ perception towards mutual funds but very few studies have attempted to target AUM although it reflects investors’ behaviour in the market and can be proved very useful in solving burgeoning issues of behavioural finance. In this study, we argue that, macroeconomic factors do not affect mutual funds because it is a derivative hence, the impact of macro-economic variables is not exclusive but via the core securities in which money is invested [3].

This study can be proved useful for various fund managers to understand the impact of macro-economic variables on the different classes of funds so that they can assess the potential impact of any abnormal change in any of the predictors. At the same time, it can help the other researchers to identify the irrational component of the investor sentiments so that investor sentiment index can be developed on the basis of methodology being proposed by Baker and Wurgler. This study also helps in determining as to which fund category is prone to negative news [4].

This paper is further divided into various sections, like first section deals with relevant literature, section two pertains data and research methodology, section three entails analysis and interpretation and section 4 encompass the key findings of the study.

Available literature indicates that ample research has been carried out to examine the impact of macro-economic variables on their target variables by various approaches like Dash and Dineash described the relationship of macro-economic variables with respect to mutual funds by applying Granger causality test and found that returns of 35.29% out of sample schemes are significantly affected by macro-economic variables like crude oil prices, MIBOR, Sensex and Foreign exchange rates [5].

The important contribution was made by Mishra who pointed out that, in the long run, growth in real Gross Domestic Product causes a change in resources mobilized by mutual funds but does not reflect any change in the short run. Loana Radu explored the link between mutual fund market and economy by examining quarterly data since 2004-2012 in Romania and corroborated the existence of linkage between mutual fund industry and economy. Similar kind of attempt was done by Kariuki in Kenya under which researcher tried to see the impact of macro-economic variables on the net asset value of Kenya’s mutual funds and concluded that performance of Kenya’s mutual fund is affected by macro-economic variables up to 70.9%.

Ayodagan, Vardar and Tunc aimed at putting emphasis on the exclusive interaction of mutual funds and stock market in Turkey and found that co-integrating bi-directional relationship exists among all categories of mutual funds and stock returns [6].

Qureshi Kutan, and Ismail investigated the relationship between the volatility in the market and flow of funds in equity and balanced mutual funds, by applying panel auto-regression model and found that flow of funds in equity mutual funds give positive feedback to market volatility and negative feedback comes from flow in balanced mutual funds. In Pakistan, Imran and Ahmed endeavoured to compare the impact of macro-economic variables on conventional mutual funds and Shariya compliant mutual funds by applying correlation and regression analysis techniques and concluded that systematic factors exert similar kind of impact on both types of mutual funds [7].

Panigrahi, Karwa, and Joshi explained the impact of economic variables on risk adjusted returns of selected equity mutual funds by employing attribute analysis and found that changes in risk adjusted returns of selected equity mutual funds can be attributed to macro-economic variables up to 52.22%. Agrawal traced the impact of 9 macro-economic variables over daily NAVS of three years of selected mutual funds from energy and gold funds and highlighted that energy funds get significantly affected by variations in money supply, significant and positive relationship between gold funds and interest rates but the major impact comes from information of related sector [8].

Gyimah, Addai and Asamoah traced the impact of macro-economic variables on financial performance of mutual funds in Ghana by using Auto-regressive Distributive Lag Model (ARDL) and found a positive significant impact of monetary policy on mutual funds’ performance in the long run.

If we talk about tracing the leverage effect in the time series Parikh tried to test the calendar anomalies by employing E- GARCH model and found the December effect in national stock exchange. Goudarzi attempted to trace the long term memory of Indian stock market by applying Fractionally Integrated E-GARCH Model and confirmed the existence of long memory property in Indian stock market. Goudarzi and Ramanarayanan tried to model volatility of Indian stock market and tried to test the news asymmetry impact by applying E-GARCH and T- GARCH model and found that bad news impacts volatility more than good news. Similar kind of results reported by Maqsood et al., by applying the asymmetric GARCH model in Nairobi stock exchange but in addition to that, they found that asymmetric GARCH models are better fit to the data than symmetric GARCH models. Ali et al., endeavoured to trace the impact of global financial crisis of 2008 on the stock markets of India and Pakistan by applying E- GARCH model and found that global financial crisis impacted the stock markets of both the countries [9].

After reviewing the literature, it is found that a lot of work has been done in this area by various researchers by following different methodologies, and in different contexts like some of the studies considered funds NAV as their dependent variables and some other studies tried to target resources mobilised as their target variable. Other studies laid emphasis on the exclusive relationship between stock market and mutual funds. One of these studies, considered Assets Under Management as the target variable and regressed it only against economic growth. If we talk about tracing the leverage effect all studies considered stock market to test the presence of it. In present study, we try to bridge these gaps by identifying the long term and short term relationship of 7 identified macro- economic variables with assets under management over a period of 2012 to 2022 and also tried to trace the leverage effect on the AUM of Indian mutual funds [10].

Objectives of the study

Since the focus of the study is to trace the impact of macroeconomic variables on the investors’ preference for mutual funds by taking AUM as a proxy for investor preference, present study attempts to fulfil two main objectives. First is to trace the relationship between AUM and identified macro-economic variables and second is to trace the impact of news asymmetry on the AUM of Indian mutual funds [11].

Proposed hypothesis

• H01: There is no significant relationship between CPI on AUM in short term and long term.

• H02: There is no significant impact of IIP on AUM in short term and long term.

• H03: There is no significant impact of Inflation on AUM in short term and long term.

• H04: There is no significant impact of Interest rates on AUM in short term and long term.

• H05: There is no significant impact of M3 on AUM in short term and long term.

• H06: There is no significant impact of SENSEX on AUM in short term and long term.

• H07: There is no significant impact of FOREX on AUM in short term and long term.

• H08: There is no news asymmetry in the AUM.

Research methodology

To check the stationarity augmented dickey fuller test and Phillips–Perron test is used. For identification of co-integration Johansen co-integration test and for examining the relationship, vector error correction model, impulse response function is and for tracing the leverage effect E- GARCH model is used [12].

Vector error correction model

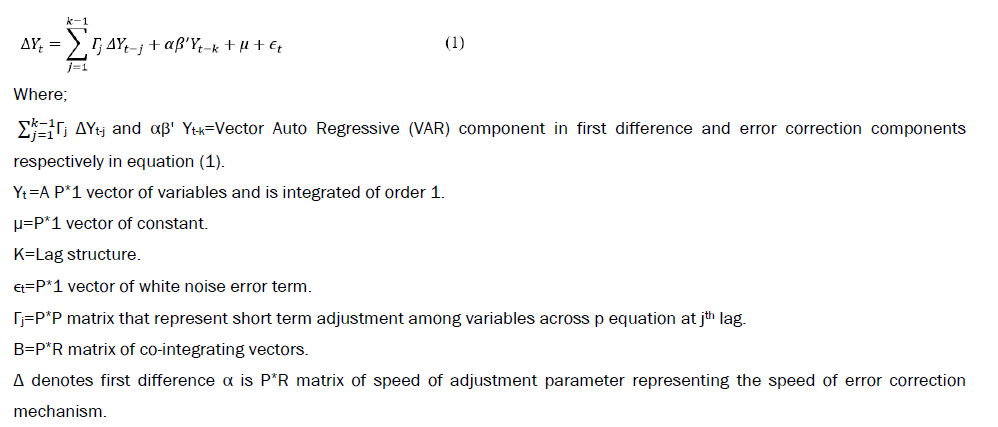

For tracing the impact of macro- economic variable on the assets under management of various mutual funds this model is used in place of Engle and Granger’s two-step error correction model because VECM helps in calculating more efficient estimators for co-integrating vectors. This is because of two prominent reason first is VECM is a full information maximum likelihood estimation model so that co-integration in the whole system of equation can be tested in one step without normalising variables specifically and other is that VECM prevents us from carrying over the errors from first step to the next step [13]. It is also free from a priori assumptions of endogeneity and exogeneity of the variables. The VECM takes the following form:

A larger α suggest a faster the process of estimation starts with checking of stationarity in data. This is the basic assumption of any vector error correction model that data needs to be stationery but at first difference I (1) and not at level I (0) if data qualifies this assumption next step is to select an optimum lag length based on various criterions. Once the lag length is identified, co-integration needs to be checked and if this relationship confirms one can go for applying vector error correction model. After applying the model residual diagnostic and stability diagnosis takes place [14].

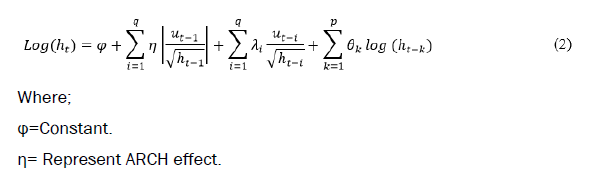

E- GARCH model

E- GARCH model was proposed by Nelson to capture the leverage effect of shock (policies, news, incidents, events etc.) on the targeted financial metric [15]. It helps in testing the asymmetries which means whether the metrics reacts to good news and bad news in the similar magnitude or not. So, the conditional variance for an E- GARCH (p,q) model conditional variance equation can be written as

λ signifies for asymmetric effect and ϴ stands for GARCH effect. So, if in an E- GARCH model if, λ1=λ2=…=0 the model is said to be symmetric but if λi<0 it implies that negative shocks generate larger volatility than good news. The log of variance series is generally used for this model because this ensure that estimates are non-negative and the leverage effect turns out to be exponential rather quadratic. For testing the leverage effect in asset under management log of the returns is used. For applying the E- GARCH model, first, the presence of ARCH effect should be checked, if there is ARCH effect present, optimum lag length is required and after identifying the optimum lag length model should be applied. After applying the ARCH -LM test it is known that ARCH effect is present in the series because the probability values of f- statistics and Chi-square test is less than 0.05 level of significance (0.0164<0.05, 0.0166<0.05). Optimum lag length is 8 based on LR, FPE, AIC, SC and HQ decision criterion [16].

Analysis and key findings

Description of data: For fulfilling the purpose of our study monthly data since January 2012 till December 2022 is considered for variables like assets under management, consumer price index, industrial production index, inflation, Sensex, M3 (measure of money supply), exchange rate. The log values of data are considered for further analysis. After looking at table below it can be concluded that Inflation has highest standard deviation whereas FOREX has lowest standard deviation. AUM, FOREX, IIP, Inflation, Interest rates and M3 are negatively skewed whereas CPI and Sensex are positively skewed. The kurtosis values of IIP (76.92745) and Inflation (3.790069) are more than 3, so the series are leptokurtic in nature whereas all other variables have platykurtic distribution because kurtosis values are less than 3 (Appendix Tables 1 and 2) [17].

Test of stationarity

For this purpose, Augmented Dickey Fuller test and Phillip Peron tests are applied. Results of both the tests indicate that, since probability values of T-statistics are greater than 0.05 level of significance at level hence fail to reject the null hypothesis of presence of unit root hence data is non-stationery at level [18]. On the contrary probability values of T-statistics are less than 0.05 level of significance (Appendix Table 3), hence rejects the null hypothesis of presence of unit root. So, it can be concluded that data is non-stationery at level but stationery at first difference [19].

Selection of optimum lag length

Based on decision criterion mentioned in Appendix Table 4 AIC is considered for selection of optimum lag and lag 3 is identified.

Co-integration test

As we can see (Appendix Table 5) that there exists one co-integrating equation. According to the results shown in Table 6 at k=3, both, Trace test and λ(max) rejects the null hypothesis r=0 in favour of r=1 at 5% level of significance. Thus, it can be concluded that there exists 1 co-integrating equation [20].

Empirical findings of VECM model

According to the analysis results of the VECM model, the co-integrating vectors are given as follows.

Β1’=(1.00, 1.56, 3.84, 0.26, 0.028, -0.98, -4.72, 0.37)

Values expressed above stands for long- term elasticity measuring coefficients (co-integration) for AUM, CPI, FOREX, IIP, INF, INT, M3 and SENSEX and can be expressed as:

AUM= -112.32-1.56CPI-3.84FOREX-0.26IIP-0.028INF+0.98INT+4.72M3-0.37SENSEX (3)

Based on the results displayed in equation above the relationship between AUM and CPI is negative which indicate that if CPI increases AUM decreases and vice versa at the rate of 1.56, since value of t-statistic is greater than the cut off rate (3.42>1.96) it can be concluded that the relationship is significant. Similarly, there is an inverse relationship between FOREX and AUM with the elasticity of 3.84 which is significant because the t-statistic value is greater than the cut off value (8.54>1.96). The inverse relationship persists between AUM and IIP which indicate that if IIP increases by 1 unit AUM declines at the rate of 0.26 which is a significant relationship because of the higher t-statistic than cut-off rate (2.97>1.96). The relationship between Inflation and AUM is also inverse but insignificant (1.41<1.96). Further, Sensex has inverse relationship with AUM but this relationship is also insignificant. The relationship between AUM and 10-year bond interest rate is positive with elasticity of 0.98 and this relationship is significant because the t-statistic value is greater than the cut-off rate (5.27>1.96). Further, the relationship between M3 and AUM is also positive and significant. The magnitude of change is 4.72 having t- statistic value -12.35 which is higher than cut off rate of |1.96.

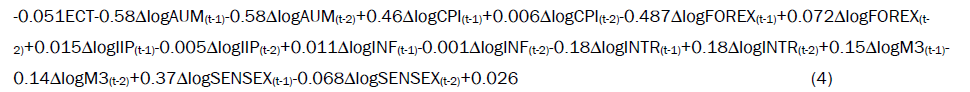

The equation for VECM model is as follows:

The equation above displays the short term relationship between AUM and identified macro-economic variables.

The coefficient for co-integrating equation is -0.051 which is negative but insignificant because t-statistic is less than |1.96| (-1.12<-1.96). This coefficient is looked upon for testing the robustness of the system. The coefficient illustrates that model is not robust and if any structural change gets introduced in the system, variables will not respond immediately and significantly. Thus, model is not suitable for policy implications and more variables are required to be incorporated for further policy implications. By looking at the coefficients and t-statistics of independent variables, it can be deduced that SENSEX at lag 1 has significant positive relationship (t-statistic being more than 1.96<2.53) with AUM which means that in short term if SNESEX at lag 1 increases AUM increases by 0.379. Rest all other variables are insignificant in short run. The R2 value of the model is 0.4541 which means that variables under study explains 45.41% variations in AUM. The model is significant with F-statistics value 5.43 which is significant at 1% level of significance (0.000000<0.01). The Durbin Watson statistics is 1.73 which is in tolerance limit of 1.5 to 2.5 and indicate that there no auto correlation in the proposed model.

Impulse response function

Impulse response function is used to trace the impact of independent variables on the dependent variable if independent variables fluctuate by 1 standard deviation.

By looking at the Appendix Figure 1 it can be seen that AUM is highly responsive to changes in the FOREX, 10 years government bond interest rates, M3 and SENSEX and less responsive to CPI, IIP and Inflation, if 1 SD change takes place in all the independent variables.

Residual diagnostics

For residuals diagnostics test of serial correlation and test of heteroskedasticity is conducted. For testing the serial correlation Breusch Godfrey serial correlation LM test was conducted which is a Lagrange multiplier test for general, high order ARMA errors. The null hypothesis for this test is that there is no serial correlation in the residual up to a specified order. By looking at Appendix Table 6 probability values of F-statistics and Chi-square statistics are more than 0.05 level of significance (0.72, 0.46 respectively) which fails to reject null hypothesis that there is no autocorrelation in the proposed model. For checking the heteroskedasticity in the model, Breusch Pagan Godfrey test which measures NR2 test statistics where N is sample size R2 is regression of squared residuals from original regression. The test statistics approximately follows a Chi-square distribution. The null hypothesis is that error variance is homoscedastic. The probability values of F-statistics and Chi-square are 0.0537 and 0.149 respectively Appendix Table 6 are more than 0.05 level of significance hence fails to reject the null hypothesis and proves that there is no heteroskedasticity in the model.

Test of stability of model

For testing the stability of the proposed model CUSUM test is conducted which requires the CUSUM line positioned in between 5% level of significance. If line crosses any of the two bounds the model is said to be unstable. In this case, CUSUM line lies in between the upper and lower bounds of 5% level of significance (Appendix Figure 2) hence it can be concluded that proposed model is stable.

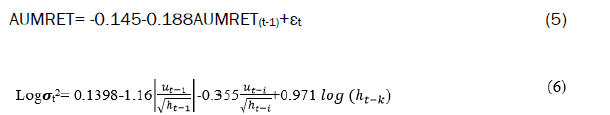

Empirical findings of E-Garch model

After the analysis, results reflect that E- GARCH model fits the data well. For testing the fitness of the data ARCH-LM test is conducted to the outcome of which shows that probability values of F-statistics and Chi-square are more that 5% level of significance (Appendix Table 7) thus fail to reject null hypothesis that there is no heteroskedasticity in the model. So, we conclude that E-GARCH (1,1) model indicate the volatility asymmetry in the AUM adequately. The mean and asymmetric volatility model based on EGARCH (1,1) were as follows.

After looking at the equation (6) existence of leverage effect is also confirmed because the value of λi<0(-0.355) and statistically significant (0.0045<0.05). So, it can be confirmed that negative news impacts the volatility of AUM more than good news.

After conducting this research, it is found that identified macro-economic variables can explain 48% of variation in AUM. The error correction term found to be insignificant which indicate that model is not robust and if any change gets introduced deliberately, the model will not return to its equilibrium. In long run CPI, FOREX, and IIP has negative and significant relationship with AUM which indicate that if Consumer Price Index increases AUM declines because it impacts the market sentiment significantly at the same time less investible income remain with investors. Inflation and SENSEX also affect the AUM inversely because where on one hand increased inflation reduces investible income, increasing SENSEX provide more lucrative investment options so investors divert their money towards share market but this relationship is not statistically significant because now a day’s investors are more likely to participate in financial markets via mutual funds. On the contrary, the relationship between M3 and AUM is positive and significant because increased M3 enables the investors to invest more. The relationship between AUM and 10-years government bond interest rates is also positive and significant because increased interest rates reduce the market value of the bond hence investors like to park their money with mutual funds with an aim to safe guard their investments. If we talk about the impact of macro-economic variables on the AUM of mutual funds in short run, it is observed that Sensex pertains significant positive impact. The results of E-GARCH (1,1) model illustrate that news asymmetry prevails in the volatility of AUM which means negative news impacts the volatility of AUM more than good news. This study may be very useful for students and researchers because it helps in establishing the fundamental relationship between AUM and macro-economic variables, for investors because it can help them in taking an informed decision about their investments in mutual funds and for fund managers so that, they can manage their portfolio considering the interplay of the identified macro-economic variables and can sneak into the change in investor behaviour due to change in the system. As this study claims that, leverage effect exists in the AUM of mutual funds it can be used as an alarm for investors as well as fund managers that swift action need to be taken in case of bad news.