e-ISSN: 2319-9849

e-ISSN: 2319-9849

Assistant Professor, Professor Aristotle University of Thessaloniki Greece, E-mail: geronik@pharm.auth.gr

Visit for more related articles at Research & Reviews: Journal of Chemistry

Pharmaceutical chemistry is the study of drugs, and it involves drug development. This includes drug discovery, delivery, absorption, metabolism, and more. There are elements of biomedical analysis, pharmacology, pharmacokinetics, and pharmacodynamics. Pharmaceutical chemistry work is usually done in a lab setting.

Pharmaceutical chemistry involves cures and remedies for disease, analytical techniques, pharmacology, metabolism, quality assurance, and drug chemistry. Many pharmaceutical chemistry students will later work in a lab. Pharmaceutical chemistry leads to careers in drug development, biotechnology, pharmaceutical companies, research facilities, and more.

The Pharmaceutical Chemistry 2020 is an event that aims to explore the ways to innovate in the field of Pharma and Chemistry, and to find new research developments on Drug Discovery and Development in London, UK on November 23-24, 2020. The conference will serve as a platform to bring together leading scientists with different specialties such as medicinal Chemistry, pharmacology, pharmacognosy and pharmaceutics etc. Pharma Congress will discuss on the topics such as Drug design, Computational Chemistry, Natural Products, Analytical Techniques, Manufacturing Practices, Validation, Drug Delivery, Biotechnology, Clinical Trails, Quality Control and Assurance, Chemical Biology and more.

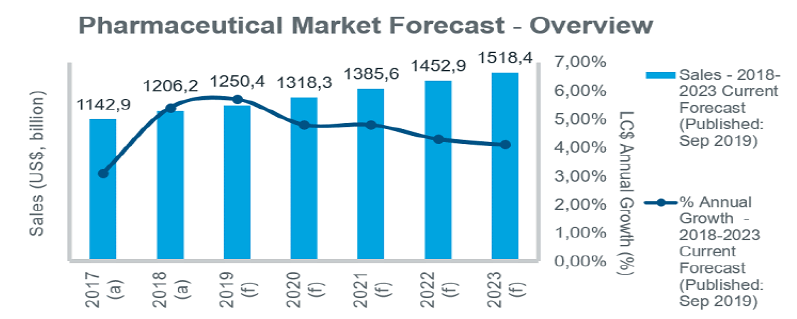

While the global pharmaceutical market is forecast to grow steadily over the next five years, a number of common opportunities and challenges are evident across different markets. Initiatives are being taken to improve access to innovative products, but cost containment remains high on payers’ agendas in all countries, and will contribute to a gradual slowing in annual growth rates over the five-year period.

While growth will remain steady in the EU5 markets, key priorities for governments over the forecast period will be price control initiatives and measures to improve patient access. In Germany the launch of new drugs will drive market growth, with at least 30 launches expected in 2019. However, the use of early benefit assessments and unpredictable outcomes of price negotiations remain an issue for manufacturers of innovative drugs. The GSAV law, which came into effect in August 2019, covers a number of different topics, including: provisions for adjusting orphan drug prices; ensuring security of supply in discount contracts between companies and health insurance funds; and measures to increase uptake of biosimilars. France is also introducing measures to improve biosimilar uptake, aiming to achieve 80% penetration rates by 2022.

Growing emphasis will be put on disease prevention and the control of chronic diseases under recent and current policy initiatives, including the new health law adopted in July 2019, which targets a transformation of the healthcare system. In Spain, price controls as a means to curb pharmaceutical spend will be ramped up over the forecast period. In Italy, the long-awaited new pharmaceutical governance strategy (published in December 2018) outlines measures to address issues affecting the underfunded healthcare system and is expected to help contain drug costs while improving patient access to new drugs. In the UK steps have also been taken to expedite patient access to new medicines through initiatives such as the Accelerated Access Collaborative, and reforms to the Cancer Drug Fund. The new voluntary pricing system for branded medicines, effective since January 2019, also aims to accelerate and extend the uptake of new medicines.

Moves to improve access to new medicines in all markets will be increasingly linked with pricing/risk-sharing arrangements. With the uncertainty about Brexit continuing, associations representing the European and British Life Science Industry have warned about the challenges across a range of business areas.

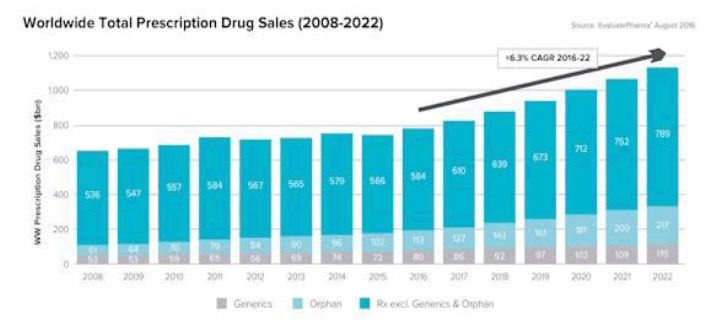

Market research firm Evaluate Pharma, in its annual World Preview report, projects a global growth rate for the pharma industry of 6.3% CAGR through 2022, up from the 5% CAGR it predicted last year for the 2014-2020 periods. Nevertheless, for investors, the “spectacular four-year bull run” of pharma and biotech valuations during 2011-2015 might be coming to an end, with uncertainties over Brexit and the US presidential election, in an atmosphere of rising skepticism over the worth of pharma products at ever-escalating prices.

The overall $1.12 trillion market in 2022, says Evaluate, will rise at a faster clip during 2016-2020, and then slow down a bit as major patent expirations take hold. (Evaluate says that the global market actually declined by 1.0% in 2015, but will grow by 4.8% this year. Prescription sales excluding generics will rise 4.4% this year, and will reach $1.006 trillion in 2022. Generics sales will increase from $73 billion in 2015 to $115 billion in 2022, and constitute 10.2% of prescription sales at that point (only 0.3 percentage points more than it is now).

Among global companies, Roche could overtake Novartis by the slimmest of margins by 2022, with sales of $52.6 billion versus $52.5 billion. Pfizer will drop to No. 3, with sales of $49.1 billion (this analysis preceded that company’s bid to acquire Medivation).

During the 2008-2015 period, the compound annual growth rate of global R&D spending was 1.7%; during the 2016-2022 periods, the rate will grow at 2.8%. The year-over-year increase, however, will remain around 3%, versus some dramatic jumps seen in 2013, 2014 and 2015. Overall spending will reach $182 billion in 2022. Top spenders in 2015 were Roche and Novartis ($8.5 billion each in 2015), Pfizer ($7.7 billion), J&J ($6.8 billion), Merck ($6.6 billion), and Sanofi and AstraZeneca ($5.6 billion each). However, in 2022, J&J will overtake Pfizer, and Sanofi will overtake Merck.

By 2022, the biggest-selling global branded drug will be Opdivo (nivolumab) from BMS and Ono Pharma, with sales projected to go from $1.119 billion in 2015 to $14,634 billion, and overtaking the current No. 1 drug, AbbVie’s and Eisai’s Humira (adalimumab), currently at $14.359 billion and dropping slightly to $13.645 billion in 2022. However, among the Top 50 drugs in the market currently, the largest growth will be seen by J&J’s Darzalex (daratumumab), an anti-CD38 antibody for multiple myeloma, projected to rise from $9 million now to $4.9 billion by 2022, a 146% growth.

Related Companies/Industries:

• Pfizer

• Roche

• Johnson & Johnson

• Sanofi

• Merck & Co

• Novartis

• AbbVie

• Amgen

• GlaxoSmithKline (GSK)

• Bristol-Myers Squibb (BMS)

Related Associations and Societies

• Chinese Pharmaceutical Association

• Connecticut Pharmacists Association

• Society of Pharmaceutical Education & Research

• Belgian Pharmaceutical Association (APB)

• Swiss Pharmaceutical Association

• American Association of Pharmaceutical Scientists

• Indian pharmaceutical association

• Commonwealth Pharmacist Association

• Federation of Pharma Entrepreneurs

• Kenya Pharmaceutical Association

Pharmaceutical Chemistry 2020 supported by the organizing committee network of renowned scientists and professional experts such as Athina Geronikaki, Aristotle University of Thessaloniki Greece, Catherine Guillou and University of Paris-Saclay, France it provided a platform for collaboration among colleagues, vendors, and academia to reveal new innovations, solutions, ideas, and emerging technologies in Pharma.

World Pharma and Chemistry Conferences going to be held during January, 2020 to December, 2020 at various cities in Europe (London, Barcelona, Madrid, Valencia, Rome, Milan, Berlin, Frankfurt, Vienna, Zurich, Dublin, Edinburgh…. and Many More..!!!

Contact us

Andrea Smith

Program Manager | Pharmaceutical Chemistry 2020

Send a mail to pharmaceuticalchemistry@brainstormingmeetings.com

Phone +44-800-014-8923

WhatsApp +44-772-359-6800